To avoid this mistake, it is important to record transactions as soon as possible and ensure that they are accurate. Adjustment entries can impact a business’s cash flow by affecting the timing of cash inflows and outflows. For example, if an adjustment entry is made to increase accounts receivable, this will increase the amount of cash that the business expects to receive in the future. On the other hand, if an adjustment entry is made to increase accounts payable, this will decrease the amount of cash that the business expects to pay in the future.

Accruals

Accruals are revenues and expenses that have not been received or paid, respectively, and have not yet been recorded through a standard accounting transaction. For instance, an accrued expense may be rent that is paid at the end of the month, even though a firm is able to occupy the space at the beginning of the month that has not yet been paid. Other times, the adjustments might have to be calculated for each period, and then your accountant will give you adjusting entries to make after the end of the accounting period. Double-entry accounting stipulates that every transaction in your bookkeeping consists of a debit and a credit, which must be kept in balance for your books to be accurate. For example, when you enter a check in your accounting software, you likely complete a form on your computer screen that looks similar to a check.

What Are Adjusting Journal Entries?

Accrued revenues are revenues earned in aperiod but have yet to be recorded, and no money has beencollected. Some examples include interest, and services completedbut a bill has yet to be sent to the customer. For example, let’s say a company pays $2,000 for equipment thatis supposed to last four years.

Firm of the Future

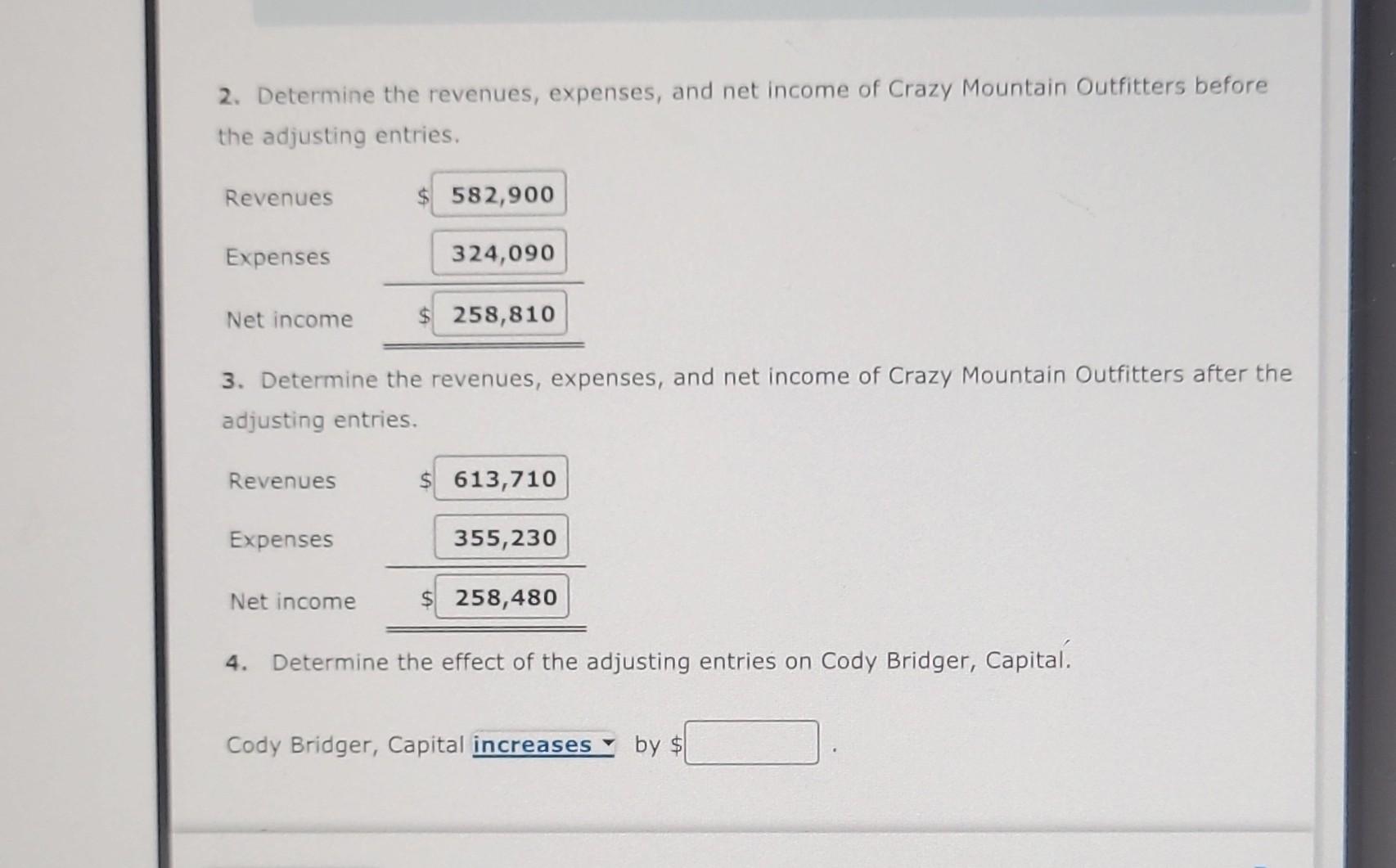

So, we make the adjusting entry to reduce your insurance expense by $1,200. And we offset that by creating an increase to an asset account — Prepaid Expenses — for the same amount. The use of adjusting journal entries is a key part of the period closing processing, as noted in the accounting cycle, where a preliminary trial balance is converted into a final trial balance. It is usually not possible to create financial statements that are fully in compliance with accounting standards without the use of adjusting entries. Thus, adjusting entries are created at the end of a reporting period, such as at the end of a month, quarter, or year.

- The life of a business is divided into accounting periods, which is the time frame (usually a fiscal year) for which a business chooses to prepare its financial statements.

- Nominal accounts include all accounts in the Income Statement, plus owner’s withdrawal.

- He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- When deferred expenses and revenues have yet to berecognized, their information is stored on the balance sheet.

- The balance sheet reports information as of a date (a point in time).

Deferrals are revenues or expenses that have been paid or received in advance. To record a deferral, an accountant would debit an asset account and credit a revenue or expense account. Entries are made with the matching principle to match revenue and expenses in the period in which they occur.

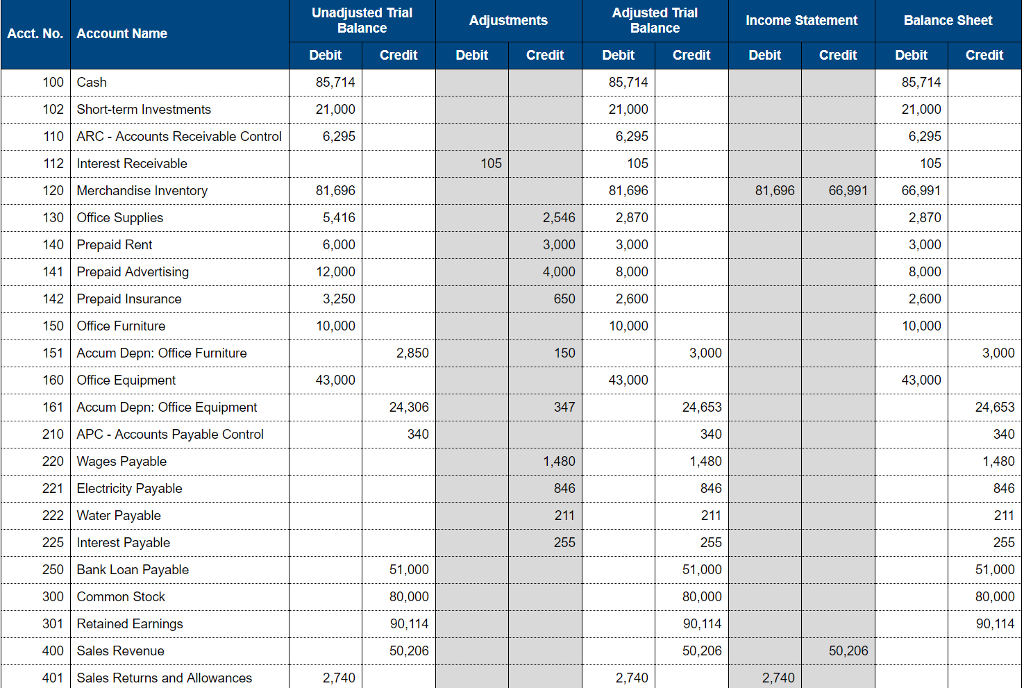

Now that all of Paul’s AJEs are made in his accounting system, he can record them on the accounting worksheet and prepare an adjusted trial balance. To credit cost of sales with the closing inventory (only used for periodic not perpetual inventory accounting systems). The first four types of adjusting entry are summarized in the table below. All adjusting entries include at least a nominal account and a real account.

If you have a bookkeeper, you don’t need to worry about making your own adjusting entries, or referring to them while preparing financial statements. In August, you positive and negative reviews record that money in accounts receivable—as income you’re expecting to receive. Then, in September, you record the money as cash deposited in your bank account.

If you use small-business accounting software — like QuickBooks, Xero or FreshBooks — you might not be familiar with journal entries. That’s because most accounting software posts the journal entries for you based on the transactions entered. In order to maintain accurate business financials, you or your bookkeeper will enter income and expenses as they are recognized in your business. Accumulated depreciation is the total amount of depreciation recorded for a long-term asset since it was acquired. To record accumulated depreciation, an adjusting entry is made to increase the accumulated depreciation account and decrease the corresponding asset account.