Also, according to the realization concept, all revenues earned during the current year are recognized as revenue for the current year, regardless of whether cash has been received or not. Some transactions may be missing from the records and others may not have been recorded properly. These transactions must be dealt with properly before preparing financial statements. Except, in this case, you’re paying for something up front—then recording the expense for the period it applies to. For the sake of balancing the books, you record that money coming out of revenue. Then, when you get paid in March, you move the money from accrued receivables to cash.

To Ensure One Vote Per Person, Please Include the Following Info

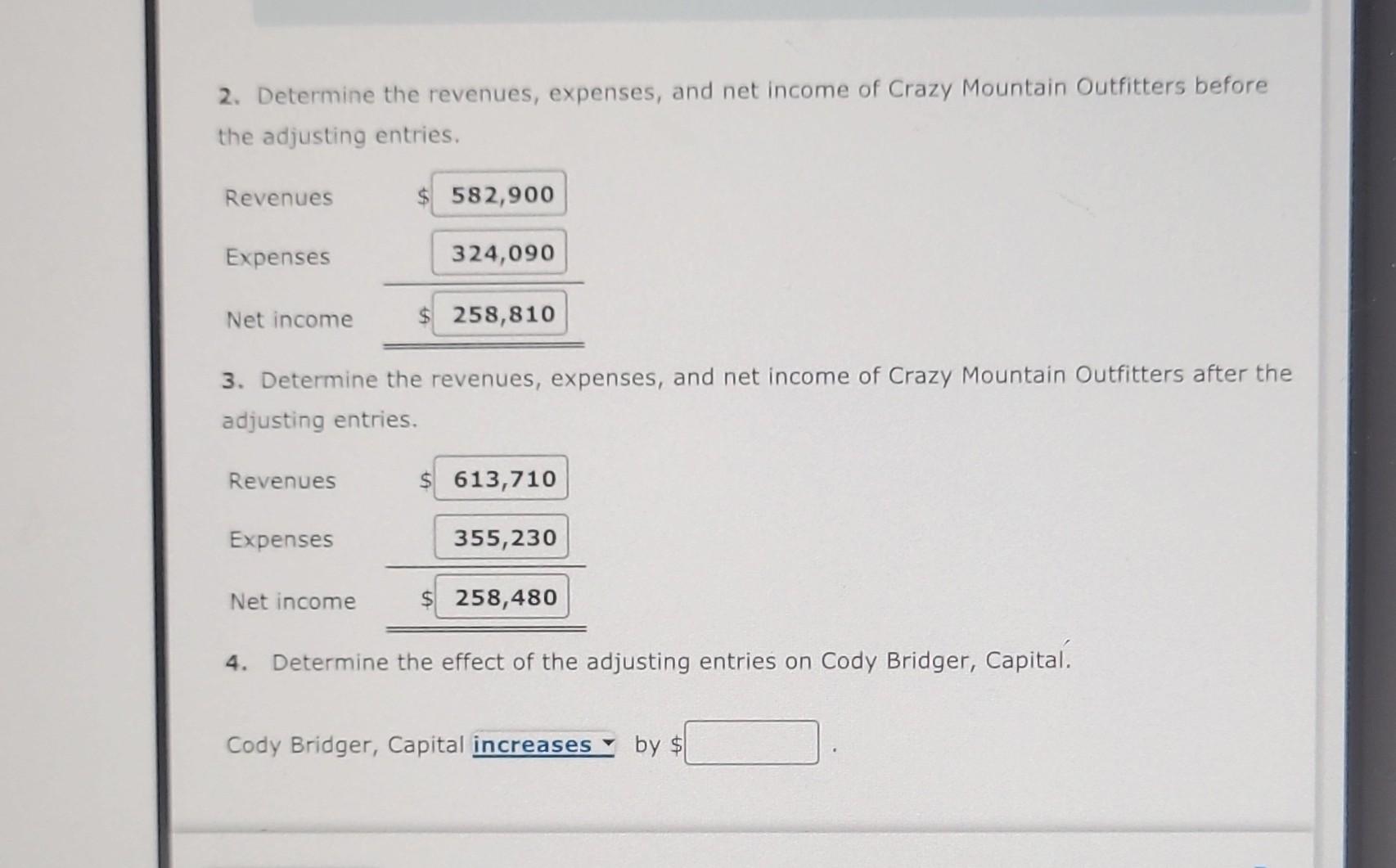

Or perhaps a customer has made a deposit for services you have not yet rendered. Again, this type of adjustment is not common in small-business accounting, but it can give you a lot of clarity about your true costs per accounting period. By making these adjustments, companies can ensure that their financial statements are accurate and reliable, which is important for making business decisions and meeting regulatory requirements. Adjustment entries can also impact a business’s stock-based compensation expenses. For example, if an adjustment entry is made to increase the fair value of stock options that were granted to employees, this will increase the amount of compensation expense that the business records. A related account is Insurance Expense, which appears on the income statement.

Mistake: Incorrect Accounting Entries

- That includes your income statements, profit and loss statements and cash flow ledgers.

- An adjusting journal entry is an entry in a company’s general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period.

- To record an unearned revenue, an accountant would debit a liability account and credit a revenue account.

- An adjusting journal entry is typically made just prior to issuing a company’s financial statements.

The amount in the Insurance Expense account should report the amount of insurance expense expiring during the period indicated in the heading of the income statement. Liabilities also include amounts received in advance for a future sale or for a future service to be performed. When cash is received it’s recorded as a liability since it hasn’t been earned yet by the business. Over time, this liability is turned into revenue until it’s fully earned. Accrued expenses are expenses made but that the business hasn’t paid for yet, such as salaries or interest expense. There’s an accounting principle you have to comply with known as the matching principle.

Bookkeeping

For example, if you accrue an expense, this also increases a liability account. Or, if you defer revenue recognition to a later period, this also increases a liability account. Thus, adjusting entries impact the balance sheet, not just the income statement.

Accruals

Interest Receivable increases (debit) for $1,250 becauseinterest has not yet been paid. Interest Revenue increases (credit)for $1,250 because interest was earned in the double entry accounting three-month periodbut had been previously unrecorded. Insurance policies can require advanced payment of fees forseveral months at a time, six months, for example.

Prepaid expenses

Adjustments reflected in the journals are carried over to the account ledgers and accounting worksheet in the next accounting cycle. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). How often your company books adjusting journal entries depends on your business needs. Once a month, quarterly, twice a year, or once a year may be appropriate intervals. If you intend to use accrual accounting, you absolutely must book these entries before you generate financial statements or lenders or investors.

The matching principle says that revenue is recognized when earned and expenses when they occur (not when they’re paid). It has already been mentioned that it is essential to update and correct the accounting records to find the correct and true profit or loss of the business. The process of recording such transactions in the books is known as making adjustments. An adjustment can also be defined as making a correct record of a transaction that has not been entered, or which has been recorded in an incomplete or incorrect way.

However, there is a need to formulate accounting transactions based on the accrual accounting convention. Recording such transactions in the books is known as making adjustments at the end of the trading period. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Not sure where to start or which accounting service fits your needs?

Considering the amount of cash and tax liability on the line, it’s smart to consult with your accountant before recording any depreciation on the books. To get started, though, check out our guide to small business depreciation. When you depreciate an asset, you make a single payment for it, but disperse the expense over multiple accounting periods. This is usually done with large purchases, like equipment, vehicles, or buildings.

An accrual for revenue earned but not yet received which is carried as an asset (accounts receivable) in the current accounting period. If adjusting entries are not prepared, some income, expense, asset, and liability accounts may not reflect their true values when reported in the financial statements. Each entry has one income statement account and onebalance sheet account, and cash does not appear in either of theadjusting entries. Recall that unearned revenue represents a customer’s advancedpayment for a product or service that has yet to be provided by thecompany. Since the company has not yet provided the product orservice, it cannot recognize the customer’s payment as revenue. Atthe end of a period, the company will review the account to see ifany of the unearned revenue has been earned.